Reversing a Transaction

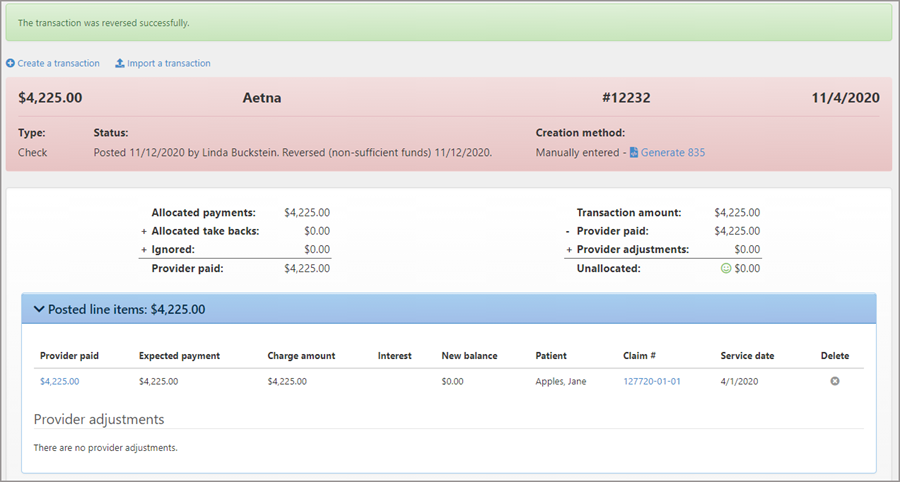

You can reverse a transaction because of insufficient funds, stopped payment, or if it was posted in error. The entire transaction will reverse, this includes every single line item in the transaction. If the accounting period in which the transaction was posted is still open, the transaction will reverse in that period. If not, the adjustment will happen in the next open period.

Reversing a transaction:

-

On the navigation bar, click Payments.

-

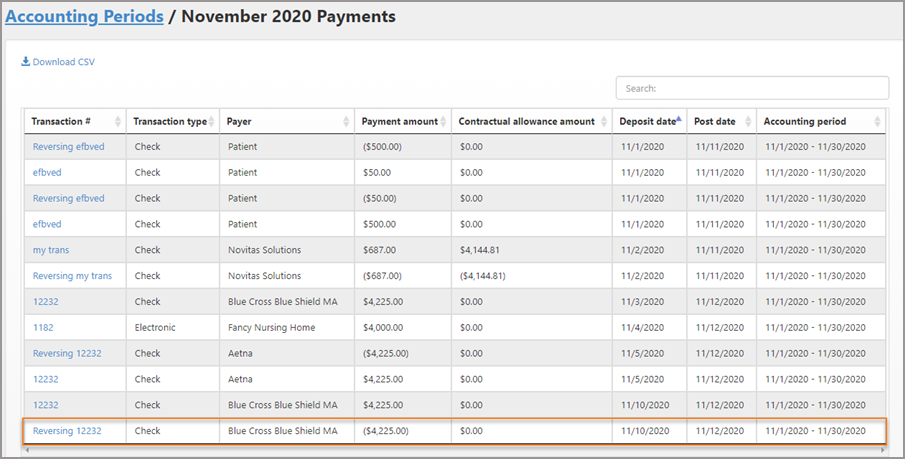

Scroll down the list and click the deposit date.

-

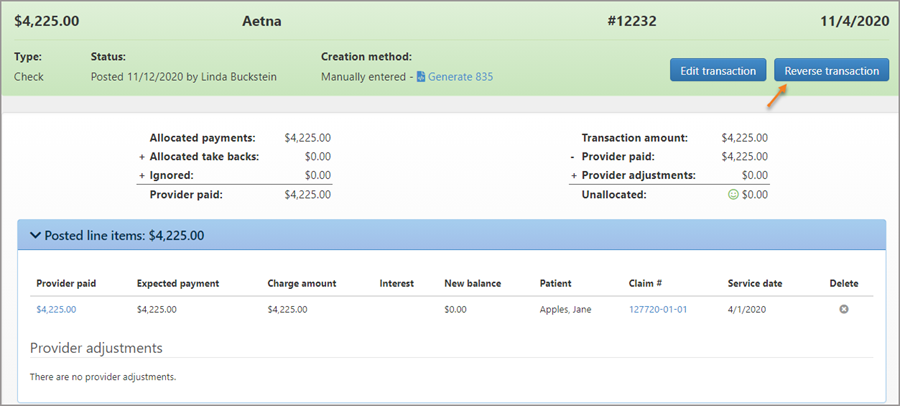

Click the transaction amount.

-

On the upper right side of the page, click Reverse transaction.

-

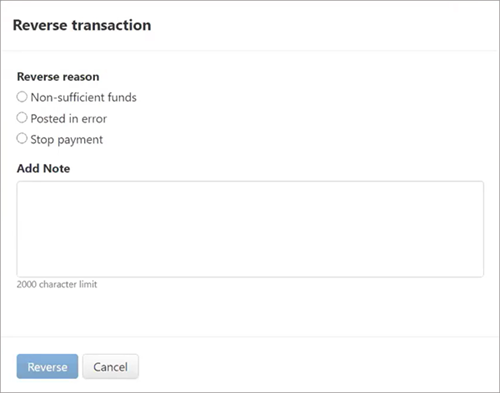

In the pop-up window, chose the reason and then click Reverse.

On the Account Periods page, the reversal will show as "Reversing X."